You can expect rapid, respectful, and straightforward service from a company that’s been helping businesses in transportation since 2011. OTR Solutions, formerly OTR Capital, offers invoice factoring designed specifically for freight companies. OTR Solutions - Best for Freight Companies

#Quick invoice factoring free

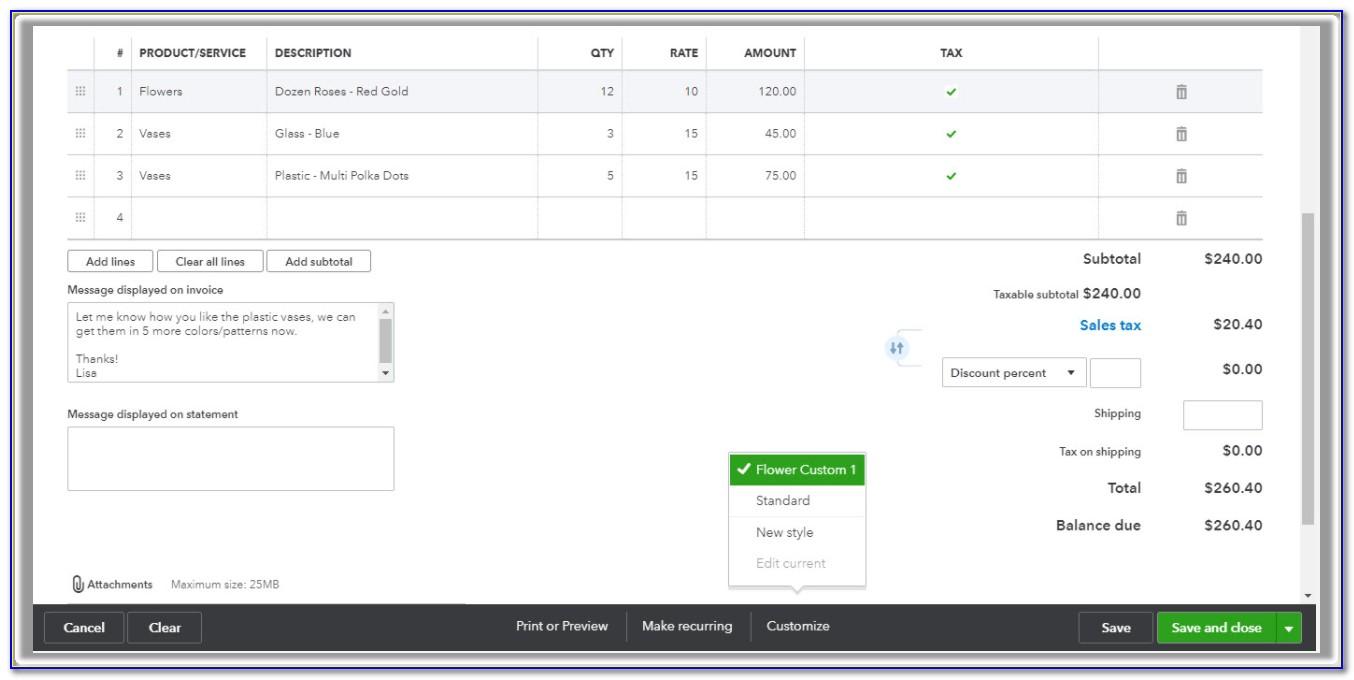

It’s free to apply, and it won’t affect your credit score. Progress billing, pre-billing, and milestone billing are not eligible for invoice financing through SMB Compass.įill out an online application to get started. This offering from SMB Compass tends to work best for invoices with net-60 terms or longer. Typically, they prefer to work with businesses in spaces like: To qualify for invoice financing from SMB Compass, you need to be in an industry with longer billing cycles. Term lengths range from six to 24 months.Īpply at SMB Compass to get cash fast for unpaid invoices. SMB Compass offers funding as fast as 24 hours, with rates starting at 12%. Not only can you get a massive cash infusion, but you can get it quickly, too. SMB Compass has provided over $250 million to more than 1,250 businesses in its history, and the company offers generous invoice financing ranging from $25,000 to $10 million. This company really stands out when compared to other factoring options, due to the amount of financing it’s willing to provide small and medium-sized businesses. SMB Compass is known for providing a versatile selection of lending options to businesses with different needs. SMB Compass - Best Invoice Financing Up to $10 Million You can try Resolve before committing with a 14-day free trial. Resolve is transparent in its fees, which are a flat 2.61% for 30-day net term invoices with a 90% advance.

#Quick invoice factoring plus

Plus Resolve integrates with QuickBooks, Magento, and WooCommerce. And as the customer, you get an easy-to-use accounts receivables dashboard to see what is happening at any time. The invoice due date is at least one week from the date of the advance payment requestĬustomers can make payments through Resolve’s white-labeled (your branding) online payment portal via credit cards, ACH transfers, wire transfers, and even checks.The invoice can be paid by one of Resolve’s approved payment methods.The customer has accepted your product/service.Resolve has done a credit check and approved the customer.The customer’s business is based in the US.To get advance payment, there is a list of criteria the company and invoice must meet:

Resolve offers immediate payment for up to 90% on approved invoices (within 1 day!) while allowing their customers to give 30, 60, and 90-day net terms to all of their customers, which helps the company expand sales and grow their businesses. And offering net terms often allows for larger orders, while your credit line can go up to $1 million. Resolve makes decisions on net terms and credit limits quickly so your business can keep moving. With their “quiet” credit check process that does not affect business credit scores, it promises your business will not be on the hook for open invoices. Unlike other non-recourse factoring services, Resolve takes on the risk of your customer’s non-payment. Resolve calls itself net terms-as-a-service rather than a traditional factoring company. They currently work with more than 1000 companies, including Linus Venice, ConEquip, and Zark LED.

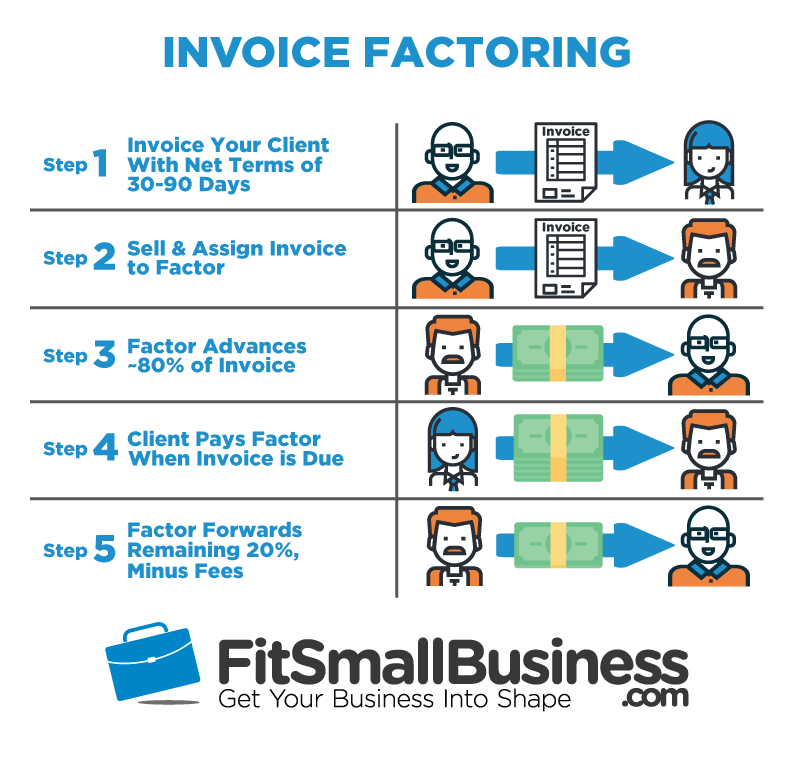

Resolve is a unique non-recourse invoice financing company that helps B2B merchants, wholesalers, and distributors offer net terms and assumes the payment risk for its customers. Best Invoice Factoring Companies Reviews Resolve - Best for offering net terms to business customers The reviews are followed by a brief guide that highlights the key criteria you should be thinking about as you assess your options.Ĭhoose the one most suited to your needs, and start getting paid for the work you did instead of spending time chasing people down. Riviera Finance – Best for guaranteed creditīelow you’ll find an in-depth review of each company that made my list.TCI Business Capital – Best for month-to-month contracts.Breakout Capital – Most flexible invoice factoring company.Triumph – Best for construction and transportation.eCapital Commercial Finance – Best non-recourse invoice factoring.OTR Solutions – Best for freight companies.SMB Compass - Best invoice financing up to $10 million.Resolve – Best for offering net terms to business customers.The 9 Best Invoice Factoring Companies of 2023 If your business has unpaid invoices and you’re low on cash, invoice factoring can be a solid solution. But for small business owners, it’s an especially frustrating reality with potentially devastating consequences. Unpaid invoices are part of running a business, no matter the size. Want to jump straight to the answer? The best invoice factoring company for most people is Resolve or SMB Compass.

0 kommentar(er)

0 kommentar(er)